Patience, in most religions and philosophies, is a virtue. One can develop great mental strength through the practice of patience. Patience can get you through difficult times and bad situations by keeping you grounded in the present instead of being enveloped in thoughts of the future – good or bad. It is necessary to visit the future for planning purposes, but you need to live in the present or you will miss out on life. The irony about patience is that it takes patience to develop patience. Patience is an art that needs to be developed over time and practiced regularly to master.

Patience photo by soccerkid29 via Motifake.com

Patience photo by soccerkid29 via Motifake.com

The best method to develop the art of patience is to keep yourself grounded in the present but working towards the future. When you see your neighbor’s new car or the diplomas hanging on your bosses wall, you need to remind yourself that those things take time and you are perfectly fine where you are right now. You have to find solace in the present before you can truly start living and slowly moving towards your goals.

Completing your degree

Whatever degree you are currently pursuing, its value is derived partly in the difficulty it is to earn it. If all you had to do was shell out a few grand and that allowed you to add a Master’s degree to your resume, the perceived value of that degree would be diminished by those decision-makers that reviewed it. Graduating from college or graduate school is partly a function of ones intelligence, but maybe more so a function of their patience. There are no short cuts. A semester is a semester and you need to painstakingly attend class after class, semester after semester until all requirements are crossed off the list and you graduate. Patience is a pre-requisite for all college degrees.

Getting out of debt

Though he rubs me the wrong way, Dave Ramsey has helped many many people get out of debt. I also don’t agree with his “no credit cards EVER” approach to life. Regardless, his program offers the discipline that many people need to get out and stay out of debt forever and I can appreciate that. Dave Ramsey employs what is called the “debt snowball plan”. His plan calls for making minimum payments across the board. With any extra cash, you consistently put that extra on the smallest debt first. Once the smallest debt is paid off, you apply all that cash to the next smallest and so on and so forth. Its a simple plan, but it takes years. Discipline is necessary, but so is patience. You have to stay with the plan and be content with the slow roll of the snowball as it builds up through the years.

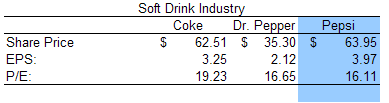

Growing Your Investments

When I was younger, I was always looking for the get rich quick investment. What I was actually doing was gambling… and losing. No I do extensive analysis and look for the biggest and most steady growers I can find. In my opinion these investments are the closest thing to a sure thing outside of U.S. Government debt (which may be less of a sure thing in the future). The most powerful investments take into account the slow accumulating magic of compounding – and those are the investments I put my money into now. I can now calculate exactly when I will be rich instead of throwing my money in the hot idea. There are a couple of caveats to my method though. I need the patience to let the slow power of compounding work and I need the health to be around for that date when I calculated I will be rich!

Finding a Significant other

There is no easy way to meet the love of your life. Its really just a numbers game. The more people you meet the more you will date. The more you date the better your chances of meeting the one. You can do things to increase the number of people you meet. This can be accomplished through sifting through vast online profiles of singles or these speed dating events. Other than that you just need to have an endless supply of patience and learn to be happy right here and right now.

Keeping up with the Jones’

The Jones’ are my mortal enemies. They live on every street in America and have the best toys. Before I developed the art of patience, I would be upset each time one of the Jones’ brought home something really cool that I wanted. Now I still like to check out their new purchases and might decide that I want to save up for something like that in the future, but I have at peace with my life and what I have.

Practice the art of being patient every day by living in the present and being content to do so. Allow the feelings of being at peace with where you are and who you are to ensure that you are becoming more patient. The next time you to the Jones’ as a patient person, you will feel good when you can enjoy other people’s successes with them and not harbor any feelings of resentment at the same time. If you continue to work toward your goals, you will eventually get there. Just value each day of your life the same whether you have reached your goal to become a millionaire or if you are falling short.

picture via picturesdepot.com

picture via picturesdepot.com