Every investor will wrestle with the notion of exactly when is the right time to sell shares of stock and every investor will have probably wished they had a few mulligans along the way. The simple answer to this question is that you sell them when they no longer meet your objectives. I know this is vague, but there are many reasons to sell and many reasons to hang on depending on those unique objectives.

Photo via http://www.techiewww.com

Trading vs. Investing

You need to first decide if you are a trader or an investor. Traders generally have a shorter expected holding period and may buy or sell based on expected events or technical analysis (the charts.) Investors usually rely on fundamental analysis and are less concerned with external events. Investors usually pick entry points based on the stock price and the price’s relationship to the intrinsic value the investor assigns to the stock. Most serious investors have been a trader and an investor at different times in their lives and for different objectives. Both methods are widely accepted and used to make money every day.

Technical Analysis vs. Fundamental Analysis

As I stated, technical analysis makes uses of a stock’s chart – a historical record of the stocks price over a certain time period. There is somewhat of a science and a serious art behind performing technical analysis. Traders look for particular patterns in the price action and use this information to predict where the price will go next. Technical analysis is concerned very little with the actual company and is concentrated on the shares. This method is actually trading the individuals and institutions buying and selling the shares more than it is trading the underlying company. The psychology of the masses invested in the shares plays a big part in whether a trader will buy or sell the shares. Admittedly, I use technical analysis on a very limited basis and am far from an authority on the method.

Fundamental analysis digs deep in the company’s financial numbers to make a decision on the future performance of the company. Fundamental analysis is not concerned with who is invested in the company and more concerned with the growth and profitability of the enterprise. Solid accounting knowledge and tools such as financial ratios are essential to the investor using fundamental analysis. An investor with a holding period of forever will most likely pick apart a company’s financial statements to paint a picture of viability investability of a particular company. The bottom line of a fundamental analysis is the stocks intrinsic value – the value an investor places on the shares. If the price of the shares is less than the intrinsic value, the shares are undervalued and should be bought, the opposite is also true.

So When Should You Sell?

Tradable Event

If you are a trader and trading based on a particular event or some other catalyst like the shape of the charts, you sell when either the event occurs or the charts change shape and indicates you take action due to impending price drop. An example of a tradable event may be the earnings press release or the announcement of a merger or acquisition.

An investor should have a holding period of forever. If you buy a stock based on the fundamentals and those fundamentals do not change, there should be no reason to sell. Enjoy the dividends or the growth of the share price derived from the growth of the company. Occasionally the fundamentals will change. Maybe a company announces that they are cutting their growth projections in half. Maybe the company announces some “accounting irregularities’- a term often used when a firm comes under investigation for their reported numbers or maybe worse.

A Shift in the Fundamentals

I owned British Petroleum for over five years when a “small fire” on an oil platform in the Gulf of Mexico was made public (I heard it first from a news agency not the company) in 2010. A few days later, the platform sunk and infamous 2010 oil leak began. I stuck with BP for about another month as they were paying dividends over 6.5% and I loved this nice income stream in my Roth IRA. Finally, I couldn’t take the pain anymore and I sold out. The price continued to drop, but I got out with a decent profit and peace of mind. I didn’t know how bad the incident was going to get and I didn’t know how much BP was going to be on the hook for. I bought BP for the strong balance sheet and that great dividend. I believed that divided would be cut (which it was) and I suspected that balance sheet would take a hit (which it did). There was no visibility in the fundamentals for me and I needed to get out. Granted the company was able to absorb the hit to the balance sheet better than I suspected, but it was time for me to move on. At that time I was moving all my free resources into natural gas – which has paid handsomely since.

Photo via http://www.fooyoh.com

A More Favorable Rate of Return

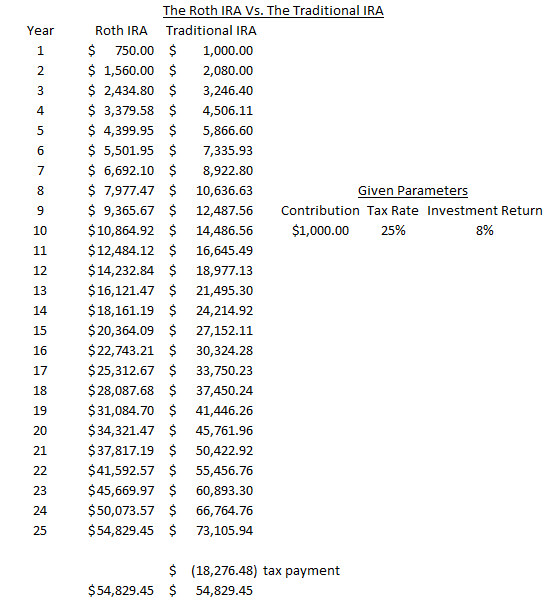

When performing your stock analysis, an integral part of the process is factoring in your required rate of return (RRR) or hurdle rate. This is the rate of return that you find acceptable for investments of a certain type. For example, you might have a hurdle rate for investments in your Roth IRA than a regular brokerage account because you don’t need to figure in your income tax expense in the Roth. Occasionally, an investment will fall below an investor’s RRR or an alternative investment will be discovered with a higher rate of return. In both of these cases an investor will be advised to sell the lower returning investment and purchase the higher returning stock.

To Bask in the Glory of Your Profits

Some investors feel the need to take profits when they have reached a certain return on the investment. This practice varies greatly from investor to investor. Warren Buffett has been known to sit on his profits for many many years instead of realize them. His logic is such that if it was a good investment 30 years ago, and the fundamentals of the company are unchanged, why realize the gain by selling and have to pay tax? Warren Buffett would not be able to sleep at night because he would be up calculating the lost profits in the future due to the amount he paid out in taxes.

Jim Cramer of CNBC is often heard yelling “bulls make money, bears make money, pigs get slaughtered.” Thus making a case for his belief that you should take the profits and enjoy paying the taxes as your reward for profits well earned. I tend to be somewhere in the middle. I have a trading account where I often take profits and have to pay the taxes. It seems counter-intuitive but, I have a few IRAs where I sell much less and there are no tax consequences to taking profits (at least not this year in my rollover IRA.)

I tend to invest more conservatively in my IRAs because having the benefit of not having to pay federal tax (on the Roth) and deferring tax (on the Rollover) is a benefit I want to hold on to. I don’t want to lose my money in those accounts and not be able to realize this tax advantage.

Deciding when to take profits or cut your losses in the stock market is one of the toughest decisions you, as an investor, will have to make. There are many reasons to sell, many reasons to hold and even many reasons to buy more (not covered here.) Buying is easy because every stock you buy will skyrocket the next day and make you rich beyond your wildest dreams or at least you tell yourself that. Like anything in the investing world it’s always prudent to err on the side of caution, know your objectives and act with conviction. One more hint, once you decide to sell, do not look back and calculate what would have happened if you had made the other decision. This is something investors do to reassure themselves. There is not looking back, only looking forward.

$