If you would like to be wealthy and have not yet been able to acquire wealth, you need to develop habits that support your objective to build it. Once developed, you then need to commit to those habits and to that objective.

People throw around the term “commitment” haphazardly these days. If you look-up the definition of “commit” on Dictionary.com, you will get an assortment of definitions all dancing around giving some sort of obligation or the act of “being committed.” While these meanings are all accurate and some people may think you will need to “be committed” to an institution once you commit to wealth-building, these terms seemed watered-down to me.

There is a huge difference in saying someone committed suicide and someone committed to a marital obligation, for example. When someone commits suicide by leaping from a roof, they cannot revisit and amend the decision on the way down – they are indeed committed to the decision in which they made. Marriage is different. Sure there is an obligation and an expectation that the union will last forever, but marriage can hardly be viewed as a commitment the same way the leap off a building can (but some may argue the outcome is the similar). The difference is the “out clause” which is implicitly or explicitly available to us in most decisions we make in life. With the divorce rate in the United States dancing around 50%, many people have revisited their decision to “take the leap!”

Committing to wealth-building is committing to a way of life and not trying out a new idea or fad that you can easily cease if the wind happens to blow from a different direction on a particular day. Similar successful commitments can be seen in the realm of weight loss. You know the before and after pictures where the individual holds up the big pants? If you read enough of these stories a common theme will emerge. These successful examples made a positive and life-changing commitment to dieting and exercising and have experienced the amazing result you see in the photo of them holding up their big pants.

These men and women developed habits that changed everything they did throughout their day. The way they shopped, the way they slept, the way they went to happy hour, they way they celebrated holidays – there is no realm of their life unaffected. Committing to building wealth is exactly the same. You will have to develop new habits in the way you shop, where you live, how you eat and every other aspect of your life. The objective is becoming wealthy and living a life of abundance and the before-and-after photo is you holding up a picture of where you dream of being.

Wealth is abundance, but wealth is not necessarily money. Having money and investments throwing off passive income can just be the instrument in which you are able to live abundantly. If you have no debt and some strategic investments paying you an acceptable return, you don’t even need high income to live abundantly and consider yourself wealthy. You can decide how to spend your time! Committing to building wealth is committing to live your life with careful management of what I call the three pillars of wealth creation – debt, income and investments.

Pillars photo by Mandy Dawn via Flickr Creative Commons

Pillar One – Debt

Debt, or leverage, is a normal part of most people’s lives and essential in managing the operations of most corporations. Getting something today and paying for it later is appealing to most people as they gain some pleasure from the purchase and want to experience that pleasure now. The acceleration of their personal enjoyment is a habit people come by innately and it is a negative spending habit that people must drop to be wealthy. Instead of making the decision to buy an item based on the pleasure derived and the time-table in which that pleasure is derived, the decision should be based on the future consequences of the decision to finance the good.

Not all debt is bad. Debt can be used to elevate one’s income (Pillar Two) through the financing of an education. Debt or leverage can also be used to provide the necessary capital for an investment (Pillar Three). Each pillar is inter-dependent on the other two pillars and strategies to increase wealth can be formed by manipulating one, two or three of the pillars. There are many scenarios one can put in play to achieve the objective of building wealth.

Pillar Two – Income

Income is often confused with wealth. If a doctor or a lawyer brings home a few hundred thousand dollars per year, they are often mistakenly labeled as “wealthy” and this is not necessarily true. The most striking example of this large paycheck phenomenon is through the observance of professional athletes. We are all inundated with the headlines every time an athlete signs a new contract for tens of millions of dollars. Then we are all shocked when we read about an athlete’s bankruptcy filing just a few years into retirement. The athlete hit pillar two out of the park (pun intended), but failed to manage the other of the other pillars.

For many Americans, income is a way to keep a roof over their heads and food on the table. They simply do not have the ability to invest as they have nothing left over. Occasionally, they even need to use credit cards to cover these basic human needs – which trigger a downward spiral of hopelessness and despair. Income and debt need to be mastered before one can begin to learn about investing. Often times, a highly-paid professional with a large house and a nice car also works just to pay the $5,000 mortgage and the lease on the Bentley. A plumber with a savings account that lives under his means will have a higher net worth that the highly-paid professional.

Pillar Three – Investments

Investment is the management of accumulated wealth. How many lottery winners go bankrupt because they are so unbelievably ignorant on investing they blow two-hundred million dollars on solid gold telephones and diamond-crusted golf balls? I am being a tad facetious – but only a tad. The hard part is getting the nest-egg built up enough to have to consider the investment pillar. On the other hand, I cannot really blame someone who is the third generation in his/her family just working on not going too far into credit card debt and trying to increase income. These negative habits are learned and passed from generation to generation. Most people are completely unaware of investing and in their realm. To them, there are only two pillars.

Saving is not investing. Saving is setting aside cash for some future purchase and attempting to earn as much interest while you wait. Savings will eventually be spent. Ideally, investments have no timeline. You should plan on never spending the principal used to make your investment. Occasionally, you may sell an investment for strategic reasons and invest the capital in a more optimal investment, but you should not shift that money to anything that is not an investment of acceptable return. You should plan on spending only the interest or dividends spun off of the investment to make your money last.

For even diligent savers and investors, reaching this investment utopia will not happen. Even in retirement, a portion of the principal invested may have to be spent to support the retiree’s lifestyle. The reasons for not reaching this pinnacle are many and depend on an individual’s age and a myriad of other contributing factors, but the concept is sound and to be committed to building wealth means being committed to this objective and being committed to this objective you need to develop habits that support this commitment in every aspect of your life.

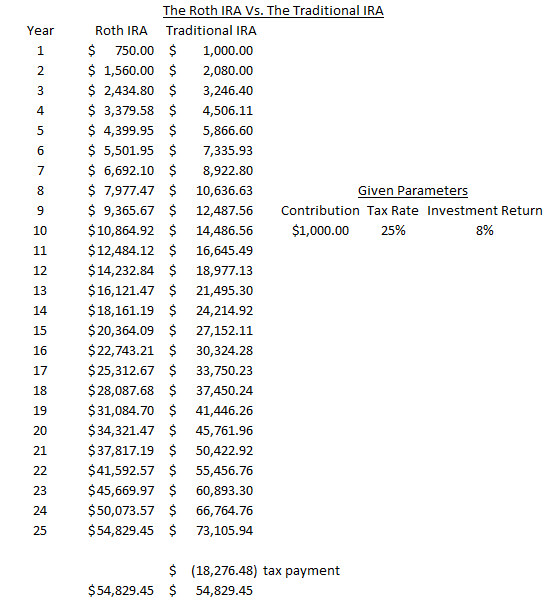

$